CaseKey Academy 2025 – Impact Track

By joining the Track, you will strengthen your ability to analyze, quantify, and defend the suggested impact of business case solutions.

How it works

4 sessions (offline, evening), + office hours

Members responsible for the impact sections of cases

September 8, 18, 29 & October 9

Attendance in all sessions is mandatory

Learning Objectives

By the end of the track, participants will be able to:

-

Understand and interpret key financial statements, especially income statements

-

Estimate and benchmark revenues, costs, and financial performance in a case-solving context

-

Apply financial KPIs such as incremental revenue, ROI, payback period, and cost-benefit ratios to evaluate solutions

-

Critically review and refine the finance and impact parts of business cases

-

Defend financial assumptions and decisions under scrutiny (“grilling”) and challenge peers constructively

Curriculum Structure

Topic: Building Blocks of Case Finance & Impact

- Introduction to the finance track and its role in case competitions.

- Income statement: how to read, structure, and interpret.

- Revenue and cost calculations: key drivers, estimation techniques, benchmarking.

- Common KPIs in business cases: incremental revenue, ROI, payback, NPV/IRR (light touch).

- Linking financial impact with timeline and risks.

- Mini exercise: interpret a simplified case-based income statement.

Case Grilling I

- New case assigned (from Academy cases already solved).

- All participants must resubmit updated finance & impact parts for this case before the session.

- 3–4 teams are selected to present and defend their revisions.

- Trainer and peers grill presenters: challenge assumptions, stress-test numbers, question risks and timelines.

- Reflection: What makes financial reasoning convincing (or weak)?

Case Grilling II

- Another new case assigned (from Academy cases).

- All participants submit updated finance & impact sections; 3–4 teams present.

- Continuation of grilling with emphasis on:

- Presenting financial reasoning persuasively.

- Spotting “red flags” – over-optimism, double counting, weak link to strategy.

- Joint discussion: balancing rigor and speed under competition pressure.

Case Grilling III & Wrap-Up

- Final new case assigned (from Academy cases).

- All participants submit their revised finance & impact parts; 3–4 teams present.

- Final grilling session and synthesis of lessons learned.

- Group debrief: What did we learn about financial impact, risk, and timelines across all cases?

- Insights from Ara Chalabyan’s career: how financial reasoning strengthens decision-making.

- Preparing for competition: packaging finance & impact for judges.

- Closing remarks & recognition of participants.

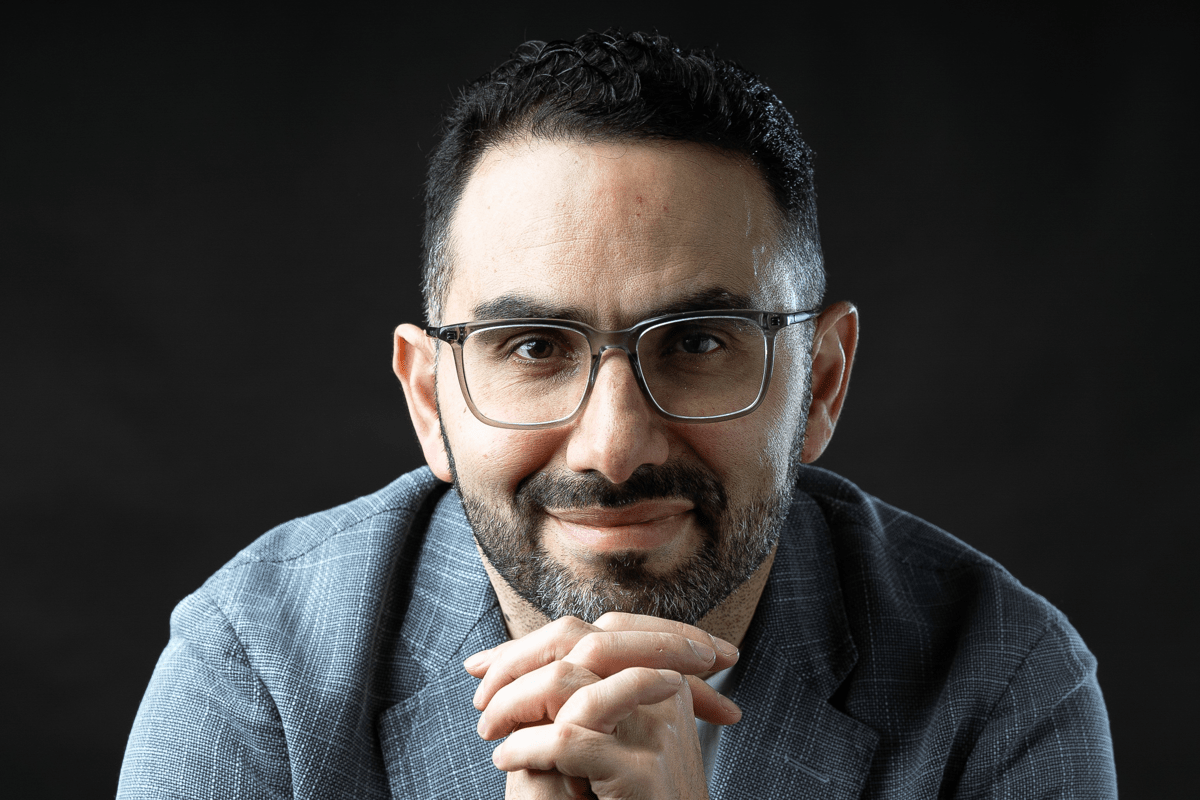

About the Trainer

-

Ara Chalabyan Ara Chalabyan brings over 25 years of experience in internal auditing, corporate finance, and operations across diverse sectors, including central banking, financial services, mining, trading, education, NGOs, and volunteer work.

About Nation 2.0 Educational NGO

Non-formal educational, entrepreneurship, and professional development platform for the youth aimed to support its stakeholders and become a change agent on the national and local economic levels

Already working at Nation 2.0 Educational NGO?

Let’s recruit together and find your next colleague.